- Crypto shorts price $371M had been squeezed, displaying the rise of speculative dominance.

- Nonetheless, weak fundamentals might rapidly reverse this momentum.

The election buildup sparked large liquidity within the choices market, wiping out $371 million in crypto shorts and driving Bitcoin [BTC] to a brand new ATH of $76K.

With a 25 bps FOMC fee lower including almost 2% because the final shut, the market’s bullish momentum is plain. This surge could propel BTC to $78K, as retail buyers rush in, pushed by Bitcoin-friendly sentiment.

Nonetheless, as proven within the delta, lengthy liquidations are stacking up, which might set off an extended squeeze earlier than the weekend. Thus, a small pullback to shake out FOMO-driven longs poses an actual danger.

Supply : HyblockCapital

In brief, those that jumped in too rapidly, influenced by the hype, would possibly discover themselves in danger if the market turns towards them.

Subsequently, strategizing at this significant second is vital. Anybody betting on fast positive factors primarily based on hypothesis relatively than strong fundamentals could face losses.

Volatility brewing because the spinoff market evolves

The election buildup, coupled with high-profile endorsements, has created the precise circumstances for BTC to probably attain $80K by the tip of this month.

Traditionally, post-election hype has triggered related reactions, however over the previous 4 years, the spinoff market has developed, with Open Curiosity (OI) now hitting a brand new all-time excessive of $45 billion.

As extra bets are positioned, the rally is more and more pushed by speculative positions, as seen with the $371M in crypto shorts being liquidated.

Previously three days alone, $26 billion in lengthy positions had been opened as speculators guess on a possible bull rally, pushed by optimism surrounding Trump’s victory.

Whereas it is a bullish sign, a scarcity of sturdy shopping for curiosity might set off an extended squeeze, jeopardizing BTC’s potential to succeed in the $80K goal.

Subsequently, the important thing now could be to refocus on the basics to gauge how the market is reacting to this evolving sample.

Can crypto shorts turn into extra susceptible?

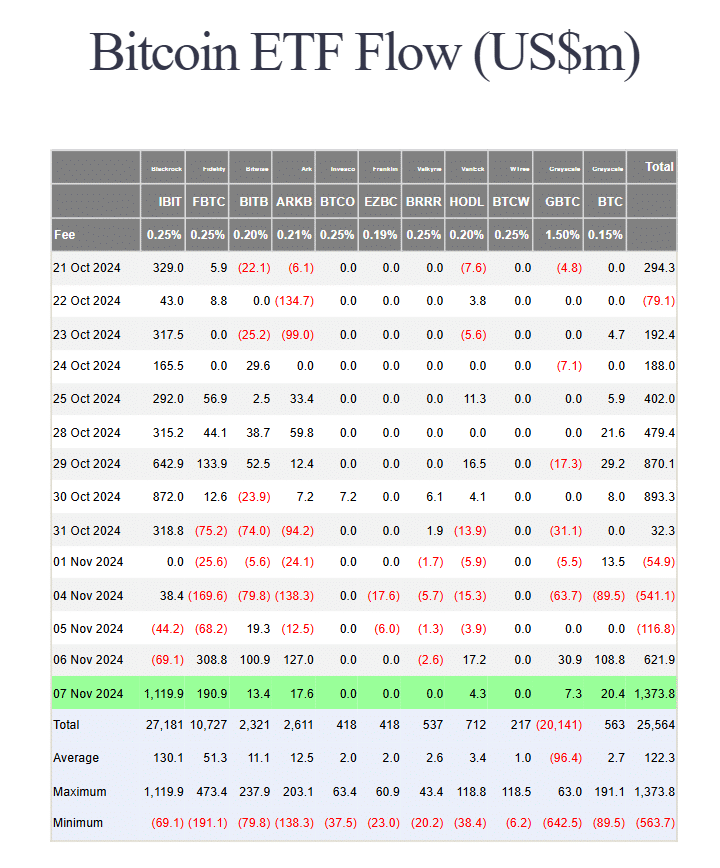

A current AMBCrypto report revealed that retail buyers are seizing BTC’s dip, driving it to new highs because it hits a market backside. In the meantime, institutional curiosity surges, with BTC ETFs seeing $1.3 billion in inflows – the biggest since its launch.

Supply : Farside Traders

For the present $76K stage to function a robust backside with the potential for a $100K surge, regular accumulation from each retail and institutional buyers is essential. With out this backing, an extended squeeze might threaten the rally.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Conversely, with sturdy assist, extra lengthy positions will probably be a part of, leaving crypto shorts more and more susceptible.

If the rally is sustainable, a long-term upward pattern might proceed, probably pushing BTC above $80K. Nonetheless, monitoring the spinoff market now could be extra essential than ever.