- Over $3.4B Bitcoin lengthy positions danger liquidation as internet taker confirmed aggressive sells.

- MSTR’s BTC holdings premium again to ranges final seen in the course of the 2021 bull run.

Bitcoin [BTC] confirmed that the $95K degree posed important dangers for leveraged positions. Because the market hovered near this essential threshold, over $3.4 Billion in lengthy leveraged bets had been liable to liquidation.

Market dynamics prompt that main gamers, also known as “whales,” may capitalize on this example to push costs all the way down to $95K, triggering these liquidations.

This tactic, identified for flushing out over-leveraged positions, may pave the best way for Bitcoin to rebound and intention for the $100K mark.

Supply: Coinglass

Merchants to remain vigilant, because the anticipated drop isn’t assured however stays extremely possible given the present market setup.

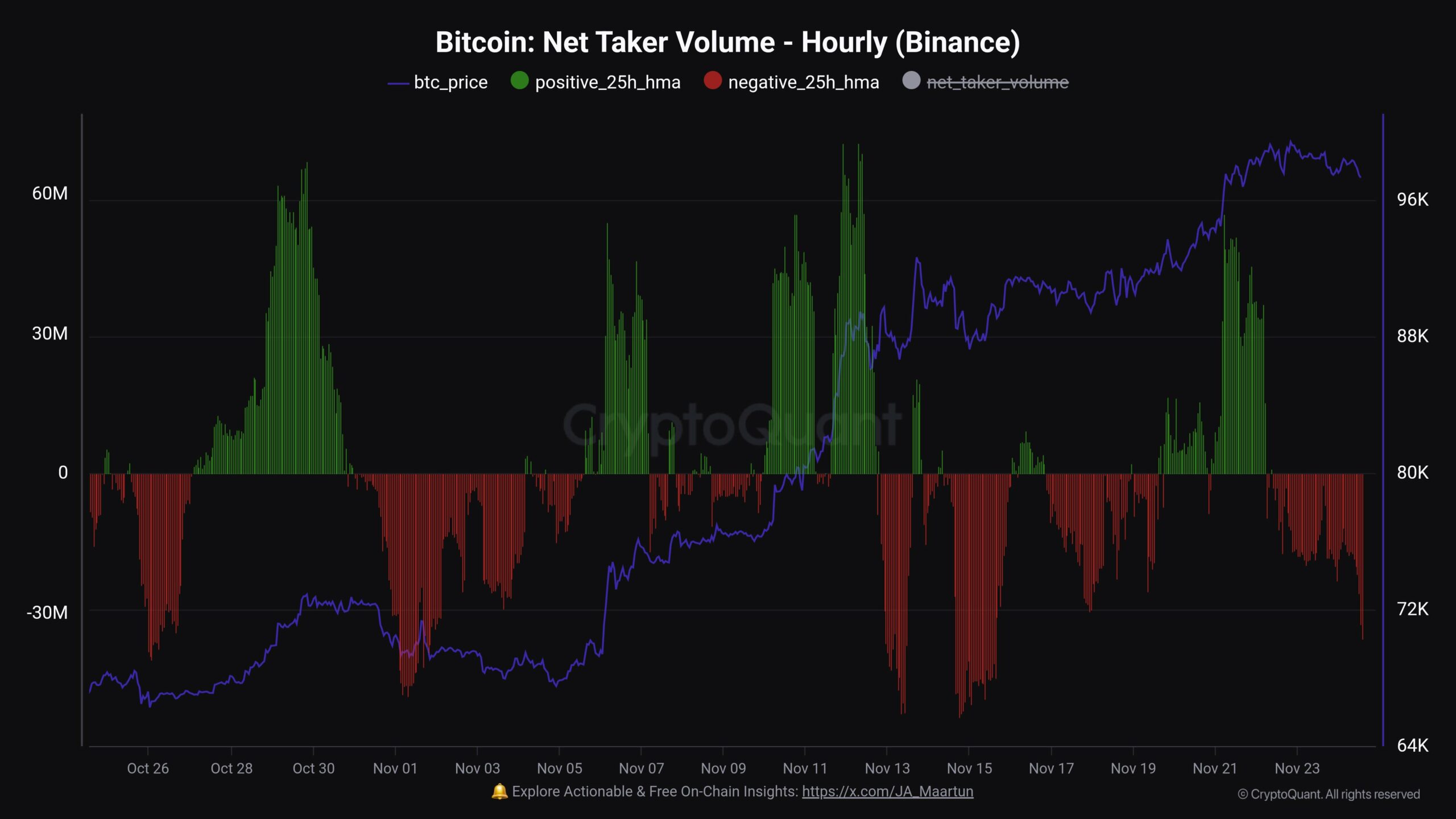

Aggressive sells and profit-taking

Additional supporting this potential drop was the Binance’s aggressive short-selling on the Bitcoin market, suggesting a possible decline to $95K to scoop up liquidity earlier than a bullish rebound to $100K.

With latest information revealing important taker promoting, market sentiment leans in direction of a strategic pullback.

This transfer, closely influenced by massive merchants, could also be a tactical play to shake out over-leveraged lengthy positions.

As market dynamics trace at a manipulation tactic, merchants ought to keep cautious of potential volatility spikes.

Supply: CryptoQuant

The noticed buying and selling patterns indicated that giant gamers could possibly be positioning for a considerable worth motion, emphasizing the necessity for vigilance within the present unpredictable market atmosphere.

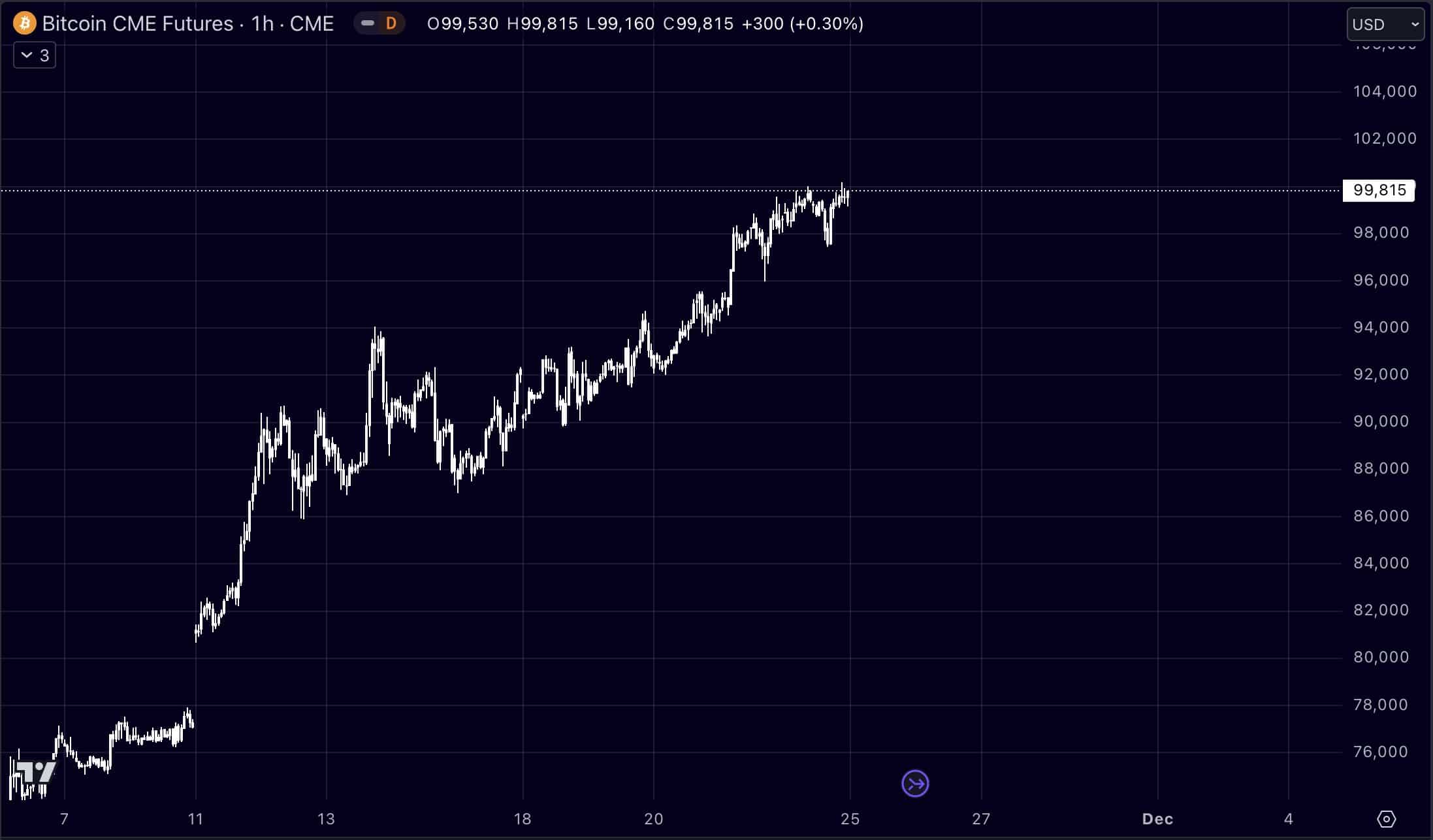

Why BTC’s drop possibly short-lived

Firstly, Bitcoin’s journey in direction of the $100K mark confirmed a mixture of volatility and anticipation. Buying and selling on the CME revealed Bitcoin flirting with $99.8K, hinting on the imminent breach of the $100K barrier.

This proximity to the milestone in a serious futures market prompt that BTC may quickly see related ranges throughout numerous exchanges. Regardless of this, a retreat to $97K signaled potential fluctuations forward.

With the CME’s pricing constantly on the upper facet, the shut at $99.8K underscores a bullish sentiment, but merchants ought to brace for potential sharp corrections or additional climbs past $100K.

Supply: Buying and selling View

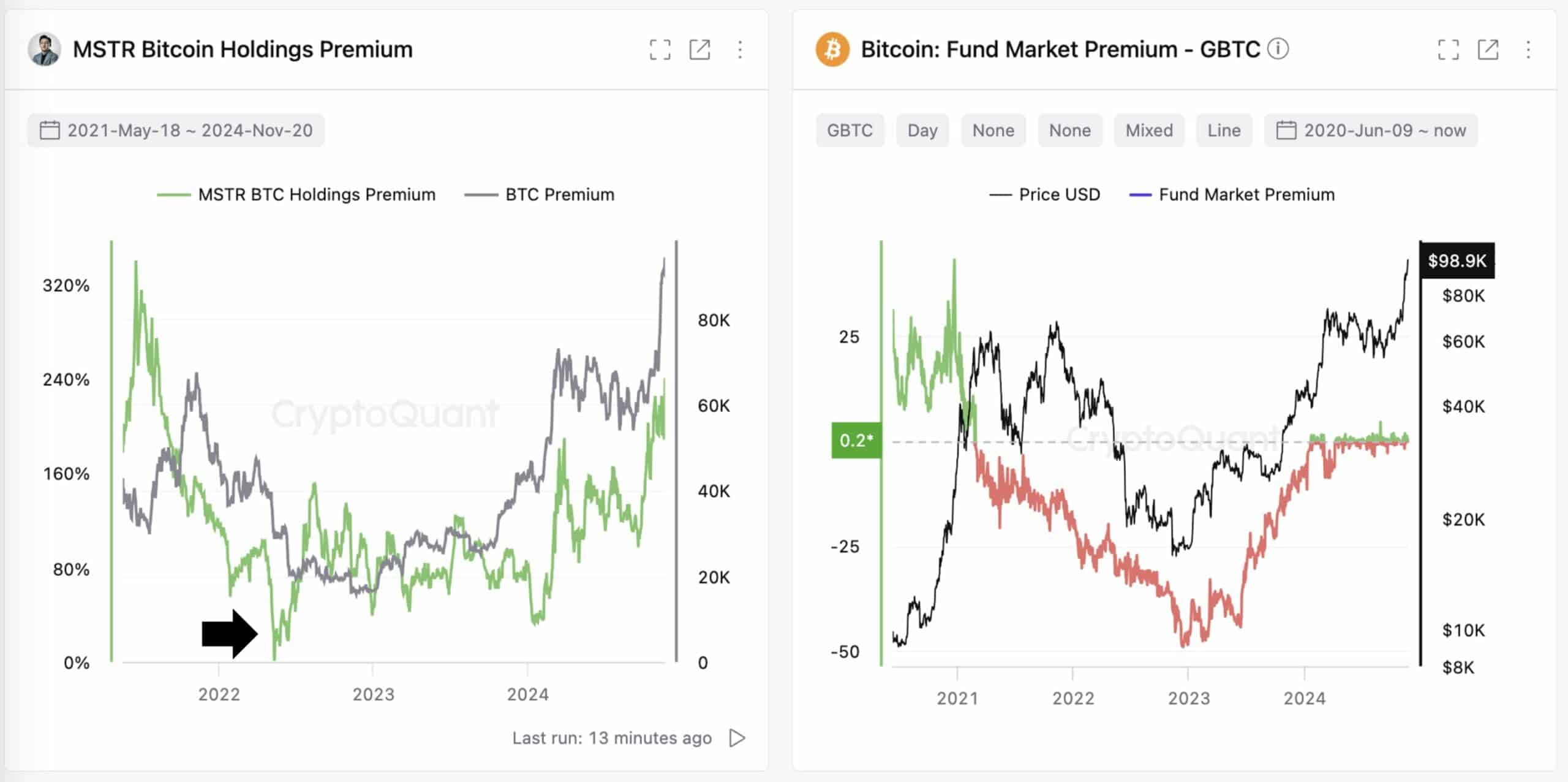

Once more, MicroStrategy’s Bitcoin holdings premium has returned to the highs of the 2021 bull run, reflecting the sooner market optimism.

Not like GBTC, which noticed a -48% low cost within the downturn, MicroStrategy’s premium constantly stayed optimistic.

This indicated Michael Saylor’s efficient danger administration in unstable instances, additional supporting that BTC’s power was nonetheless in.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Because the market once more reveals indicators of vitality, Saylor’s strategy to sustaining stability regardless of the 2022 bear market pressures indicated his important affect and foresight within the cryptocurrency area.

This resilience prompt a strategic positioning that might favor long-term buyers trying to leverage Bitcoin’s market cycles. The market stays on edge, illustrating the standard dynamism of crypto buying and selling.