- U.S. state-level BTC Reserves may appeal to $23B in demand.

- Utah’s Reserve invoice progressed a lot and led the remainder, adopted by Arizona.

Because the market waits for the feasibility of a U.S. nationwide Bitcoin[BTC] Reserve by President Donald Trump’s digital asset working group, an analogous momentum led by states has picked tempo.

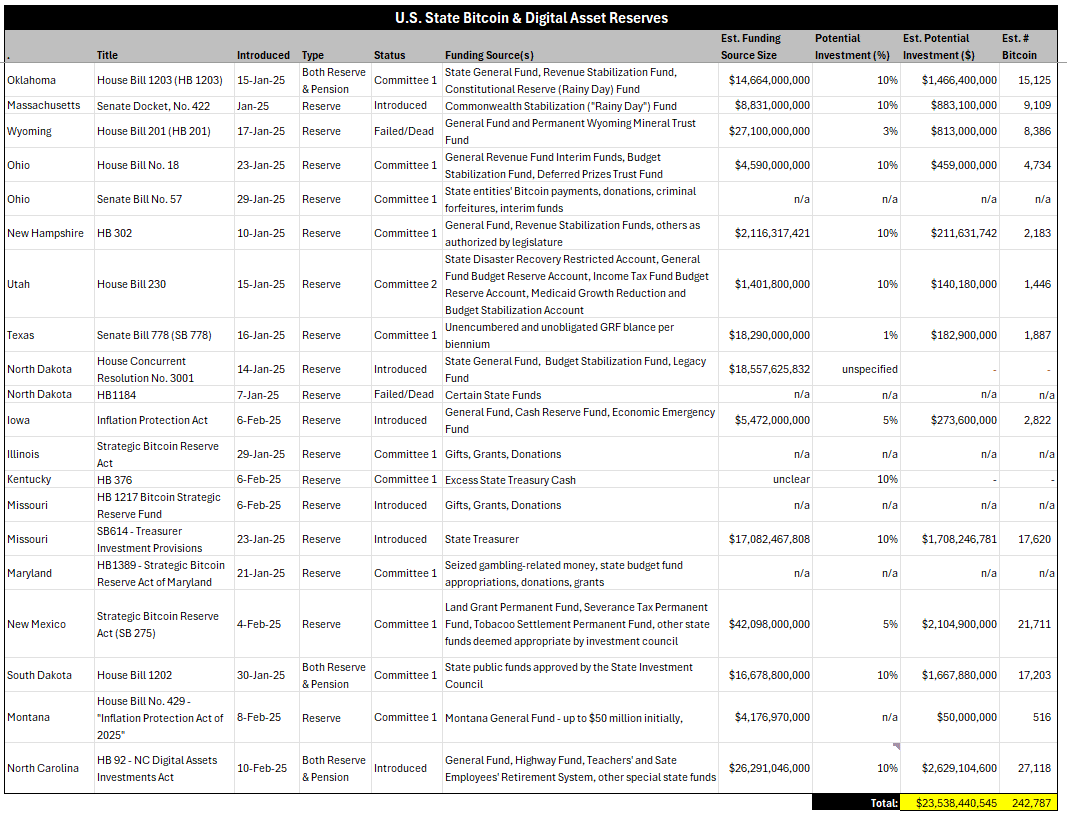

Mathew Sigel, VanEck’s Head of Analysis, projected that 20 U.S. state-led BTC Reserve payments, if accepted, may generate +$23B demand for the king coin. Sigel acknowledged,

“If enacted, they could drive $23 billion in buying, or 247k BTC. This sum is independent of any pension fund allocations, likely to rise if legislators move forward.”

Supply: VanEck

Is a BTC provide shock coming?

Whereas some have capped the fund allocation between 1%-10%, some states haven’t any limits.

In line with Pierre Rochard, VP of Analysis at BTC miner Riot Platforms, Texas’ invoice has not capped the BTC allocation quantity.

He mentioned,

“The new legislative text for the Texas Strategic Bitcoin Reserve, SB 21, is very bullish! It removes the annual buying limit of $500 million; the legislature can appropriate as much as it wants to save BTC.”

Merely put, the demand may surpass the $23B estimated by VanEck.

Commenting on the identical, Andre Dragosch, Bitwise Europe’s Head of Analysis, famous that the demand could be 2.5X the annual BTC provide.

“So, the 20+ US states would probably buy as much bitcoins as the federal government already. Combined, they would already soak up around 2.5x times the annual new supply of bitcoins.”

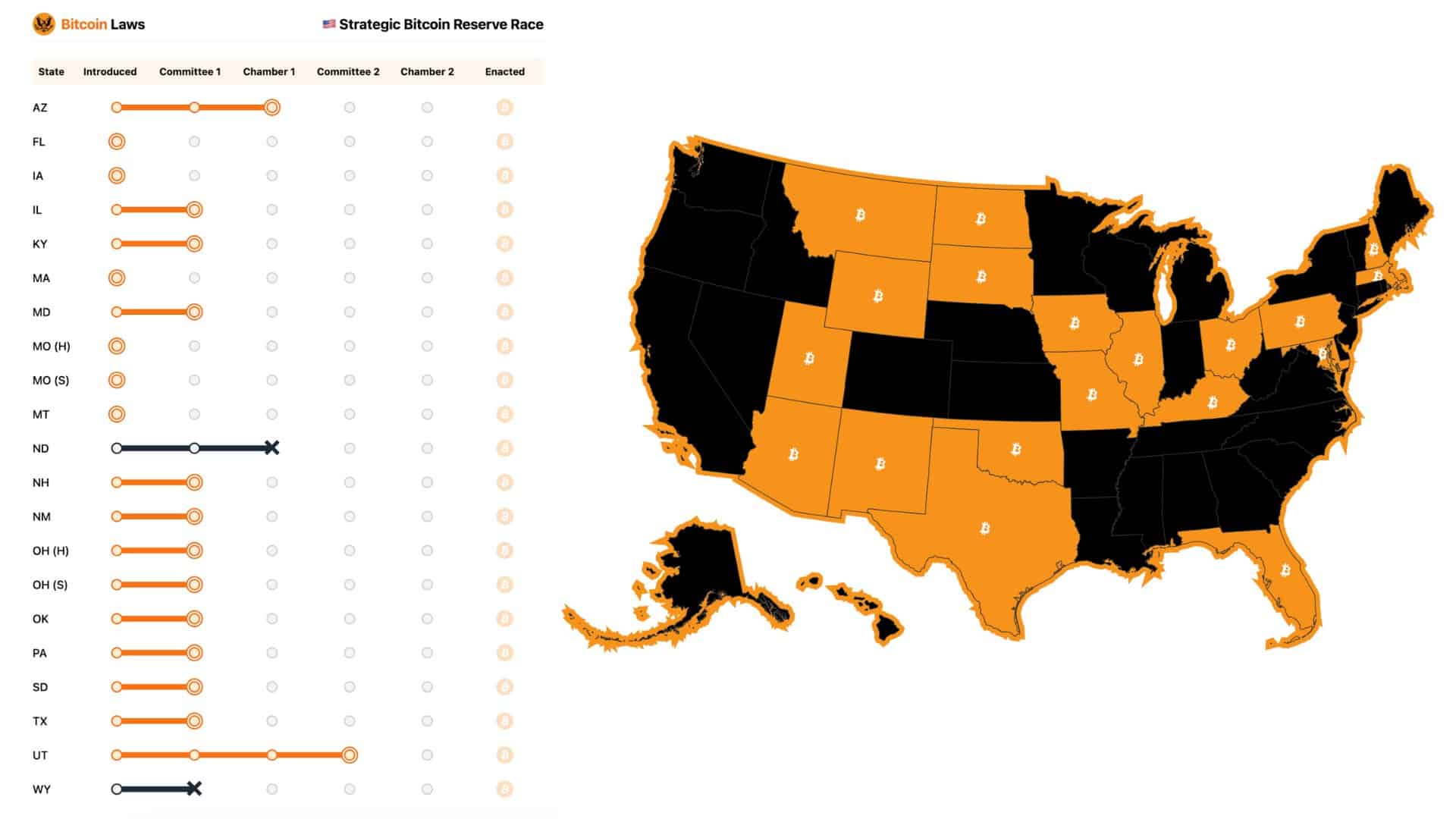

Supply: Bitcoin Legal guidelines

That mentioned, Utah and Arizona payments led the remainder after continuing to the second studying and first chambers. Nonetheless, three state payments, together with Wyoming, have did not progress.

It stays to be seen if Utah would be the first state to legally create a BTC Reserve. The influence on BTC demand dynamics remains to be unsure.