Picture supply: Getty Photographs

Penny shares are inherently dangerous because of their small market caps and risky costs. With out the stable basis of a long time of enterprise and dependable funding, a small drawback can derail a small firm.

As a extremely risk-averse investor, I are likely to keep away from penny shares for that purpose, however I additionally recognise the chance. In any case, even at present’s mega-cap shares have been penny shares sooner or later.

So for buyers seeking to get in early and intention for life-changing wealth, the attraction is obvious.

With that in thoughts, I’ve recognized two micro-cap shares that I feel may benefit from the latest uptick in gold curiosity following US inflation knowledge.

Serabi Gold

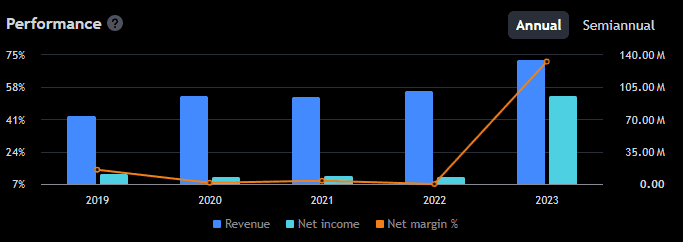

Headquartered in Cobham, Serabi Gold (LSE:SRB) explores and excavates for gold and copper in northern Brazil.

Much more than gold, Serabi has been on a tear this yr, up over 120%. In actual fact, a latest worth surge took it simply outdoors of penny inventory territory to 108p. However with an £80m market cap, it’s nonetheless very a lot a micro-cap inventory.

Much more spectacular than the value surge is earnings, up 339% up to now yr. Clearly, it struck gold! This additionally means it has a low price-to-earnings (P/E) ratio of round 5, properly beneath the business common of 9.9.

That implies there might be extra room for development.

With an expectation of robust future money flows, it’s now estimated to be undervalued by 87%. What’s extra, earnings are forecast to proceed rising at a price of 37.8% per yr.

My core concern is that it’s coming near a five-year worth excessive. That would result in vital promoting stress if buyers look to take revenue. Plus, it’s intently tied to the gold worth so any drop there may be prone to harm the share worth.

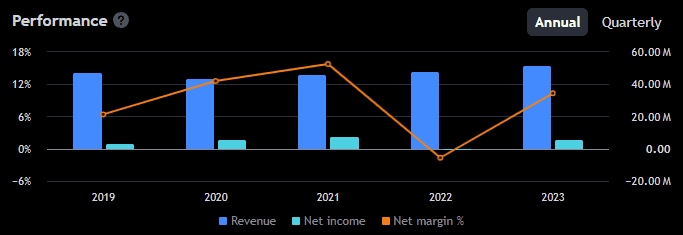

Metals Exploration (LSE: MTL) is one other micro-cap mining outfit that benefited from this yr’s gold worth development. It’s up 76% yr up to now and 344% over 5 years.

The enterprise is headquartered in London however operates within the Philippines. It excavates for gold and treasured metals from mines north of the capital, Manila. Regardless of the next £88m market cap, the shares, at solely 5p, are less expensive than Serabi.

And never because of poor efficiency — earnings elevated 213% up to now yr with income shut behind. Money has additionally been rising steadily for the reason that firm turned worthwhile in 2020.

Consequently, it’s estimated to be buying and selling at 90% beneath truthful worth utilizing a reduced money move mannequin. It additionally has a squeaky clear steadiness sheet, with no debt and $191m in fairness.

There’s a massive ‘but’ although, and in contrast to Sir Mixalot, I don’t like massive buts.

Earnings are forecast to say no by a median of 60.3% per yr for the following three years. That’s not completely shocking — contemplating the latest development — but it surely received’t look good within the interim outcomes. It may spook shareholders and result in a fall in worth. And the value is already very risky, rising 117% earlier this yr solely to crash 35% straight after.

So it’s not for faint-hearted buyers like me!

As talked about above, I don’t have the chance urge for food for risky penny shares so I received’t be shopping for both inventory. However for courageous buyers seeking to achieve publicity to gold, these two exhibit higher development potential than related rivals I’ve researched and are value a glance.