Picture supply: Getty Photos

I’m trying to find high-yield dividend shares to purchase proper now. I’m additionally seeking to diversify my holdings by shopping for a big-paying exchange-traded fund (ETF).

Listed here are three such investments on my listing in the present day. As you may see, the dividend yields on these London Inventory Change-listed devices sail above a ahead common of three.6% for FTSE 100 shares.

| Dividend inventory | Ahead dividend yield |

|---|---|

| Greencoat UK Wind (LSE:UKW) | 7.6% |

| Invesco US Excessive Yield Fallen Angels ETF (LSE:FAHY) | 6.7% |

Dividends are by no means assured. But when forecasts are correct, a £15k funding unfold equally throughout these shares and this ETF would give me a £1,080 passive revenue in 2025.

I’m assured, too, that dividends will march greater over the time. Right here’s why I’d purchase them if I had the money readily available to take a position in the present day.

Greencoat UK Wind

Vitality producers like Greencoat UK Wind are sometimes thought of a few of the most secure dividend shares to purchase.

Preserving generators in good working order will be an costly, earnings-damaging enterprise. However firms like this additionally get pleasure from glorious earnings visibility due to their ultra-defensive operations. This could make them extra secure dividend payers than many different UK shares.

Electrical energy demand stays secure no matter financial, political, or social disaster comes alongside. And so Greencoat UK Wind, which produces energy from 49 websites and sells it onto vitality suppliers, enjoys a gradual circulate of revenue it may possibly pay to its shareholders.

Whereas dividends are by no means assured, Greencoat’s vow to pay “an attractive and sustainable dividend that increases in line with RPI” has been in impact since its IPO a decade in the past.

In reality, dividends in 2023 rose virtually 30% yr on yr, hovering previous retail worth inflation (RPI) of 13.4%. Greencoat is ready to hold this report up as nearly all of its contracts are linked to both RPI or shopper worth inflation (CPI).

Given the intense outlook for renewable vitality demand, I believe Greencoat UK could possibly be a high dividend payer for years.

Invesco US Excessive Yield Fallen Angels ETF

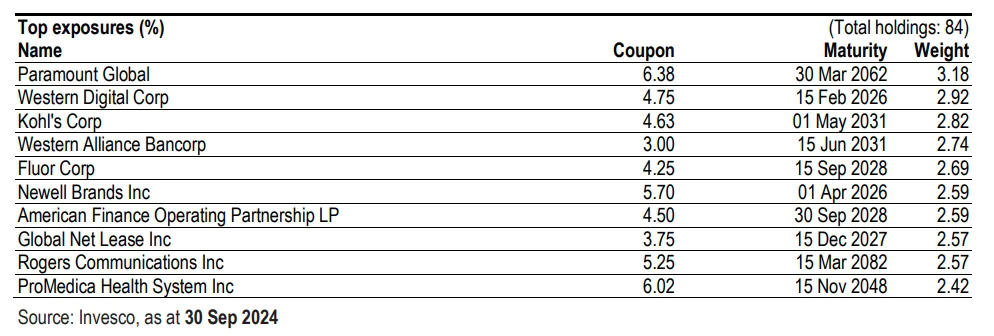

The Invesco US Excessive Yield Fallen Angels ETF supplies a manner for traders to revenue from the bond market. Extra particularly, it goals to measure “the performance of ‘Fallen Angels,’ bonds that were previously rated investment grade and were subsequently downgraded to high yield bonds”.

Round 85% of credit score scores on its company bonds are rated BB, with the rest at B.

Whereas scores go a lot decrease, these sub-investment-grade securities imply that traders are nonetheless uncovered to a better stage of credit score threat than different bond-holding funds. A downgraded ranking is an indication of issues with the bond issuer’s underlying monetary well being.

Nevertheless, with this larger threat comes the potential for larger reward. And on this case the dividend yield is a whisker away from 7%.

What’s extra, the fund has an ongoing annual cost of 0.45%, which supplies stable worth. It’s one other manner I’d think about concentrating on an enormous passive revenue subsequent yr.