Picture supply: Getty Photos

Penny shares may be famously thrilling investments. And never essentially in a great way.

These small-cap shares are sometimes younger firms which have important progress potential. If issues go proper, they’ll expertise blockbuster income progress that drives their share costs by the roof.

Nonetheless, penny shares also can typically expertise important worth volatility, a mirrored image of weak liquidity and excessive ranges of speculative buying and selling. They will fall particularly sharply when financial circumstances worsen and fears over their steadiness sheet power improve.

Shopping for low-cost

For this reason it may be a good suggestion to purchase penny shares that carry low valuations. The danger of a pointy share worth fall may be restricted, because the market has already taken a pessimistic view of the corporate’s prospects.

Shopping for any low-cost inventory has different benefits as nicely. If the corporate performs strongly, the share worth can explode as buyers recognise the true worth of the enterprise.

With this in thoughts, listed below are two prime progress shares I believe are value an in depth look at the moment.

Gold star

Buying commodities shares could be a wild journey. Costs of uncooked supplies are sometimes risky, which suggests these shares can soar or sink at a second’s discover.

However a shiny outlook for valuable metals means investing in gold producers might be a good suggestion. Serabi Gold (LSE:SRB), which trades at 66.5p per share and has a market cap of £50.4m, is one such firm on my radar.

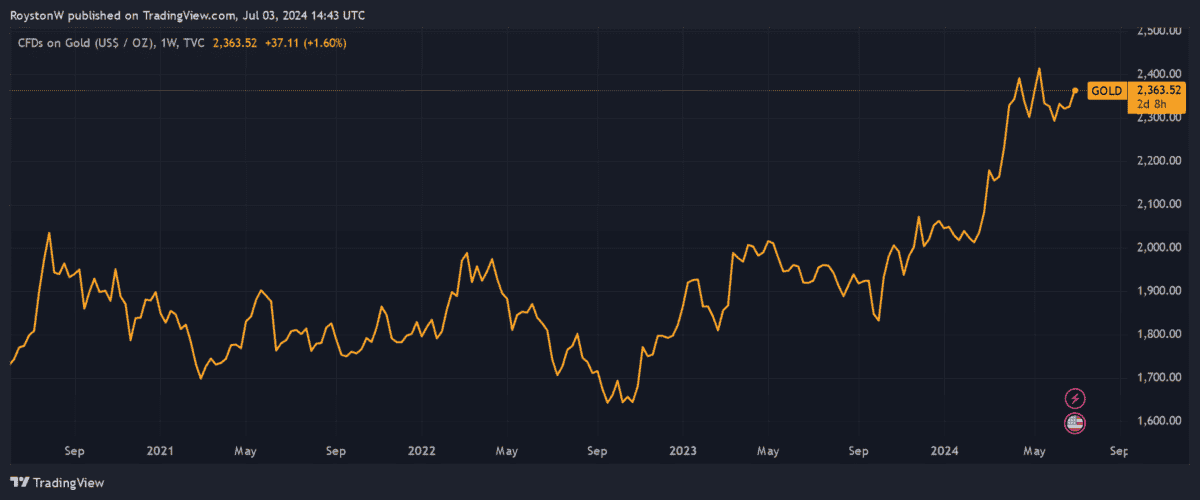

There’s no assure that gold costs will rise past Could’s report peaks round $2,450 per ounce. However a ‘perfect storm’ of things exists which may drive steel costs a lot larger. These embody:

- Cussed world inflation

- Main electoral shifts in Europe (and particularly France)

- Important authorities debt, significantly within the US

- Continued weak spot in China’s financial system

- Rising Western tensions with Russia and China

However why purchase Serabi Gold shares to capitalise on this? For one factor, its shares supply good worth at the moment. The Brazilian miner trades on a rock-bottom ahead price-to-earnings (P/E) ratio of 4 instances.

Gold manufacturing can also be rising because the enterprise ramps up output at its Coringa asset. Group manufacturing rose 12.5% between January and March, representing the best quarterly complete since 2021.

Block social gathering

Michelmersh Brick Holdings (LSE:MBH) is one other good worth penny inventory to contemplate at the moment.

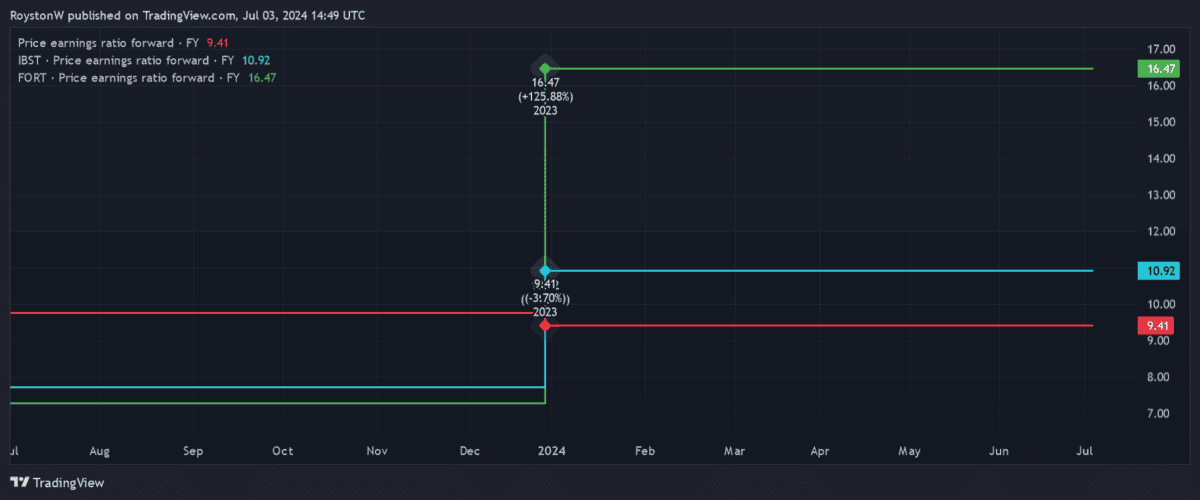

On the present worth of 95.4p, the £93.7m cap enterprise seems considerably undervalued in comparison with a few of its friends. The hole between its ahead P/E ratio of 9.4 instances, and people of rivals Ibstock (in blue) and Forterra (in inexperienced), is proven under.

What makes brickmakers like this such a horny funding although? Admittedly, demand for properties within the UK is presently weak resulting from higher-than-usual rates of interest. This may stay a risk if inflation fails to remain low.

Nonetheless, the long-term outlook for the housing market stays sturdy. Britain might want to ramp up housebuilding exercise considerably within the coming years to fulfill the lodging wants of its rising inhabitants. So gross sales of all types of building merchandise might be set for lift-off.

Michelmersh also can anticipate brick demand from the restore, upkeep and enchancment (RMI) market to stay sturdy. Britain’s historic housing inventory requires fixed renewal to remain standing.