- USDT provide jumped by 0.37%, aligning with Bitcoin’s 2% decline from the day gone by.

- If confidence in a restoration fades, large capitulation would possibly observe.

In the course of the latest market consolidation, stablecoins have surged. For the reason that ninth of September, USDT and USDC market cap elevated by $1.153 billion—USDT up $410M and USDC up $743M.

This coincided with Bitcoin’s [BTC] rise to $60.5K, a 12.04% achieve in every week.

Therefore, this capital inflow was essential to Bitcoin’s surge. Now, with the market retracing right into a bearish pullback, are traders assured in a value restoration?

Improve in USDT provide

Whereas Bitcoin noticed a 2% decline on the sixteenth of September from the day gone by, USDT circulating provide jumped from $54.14B to $54.34B.

This elevated liquidity could help potential Bitcoin value will increase within the coming days, assuming there may be much less reliance on USDT as a secure haven.

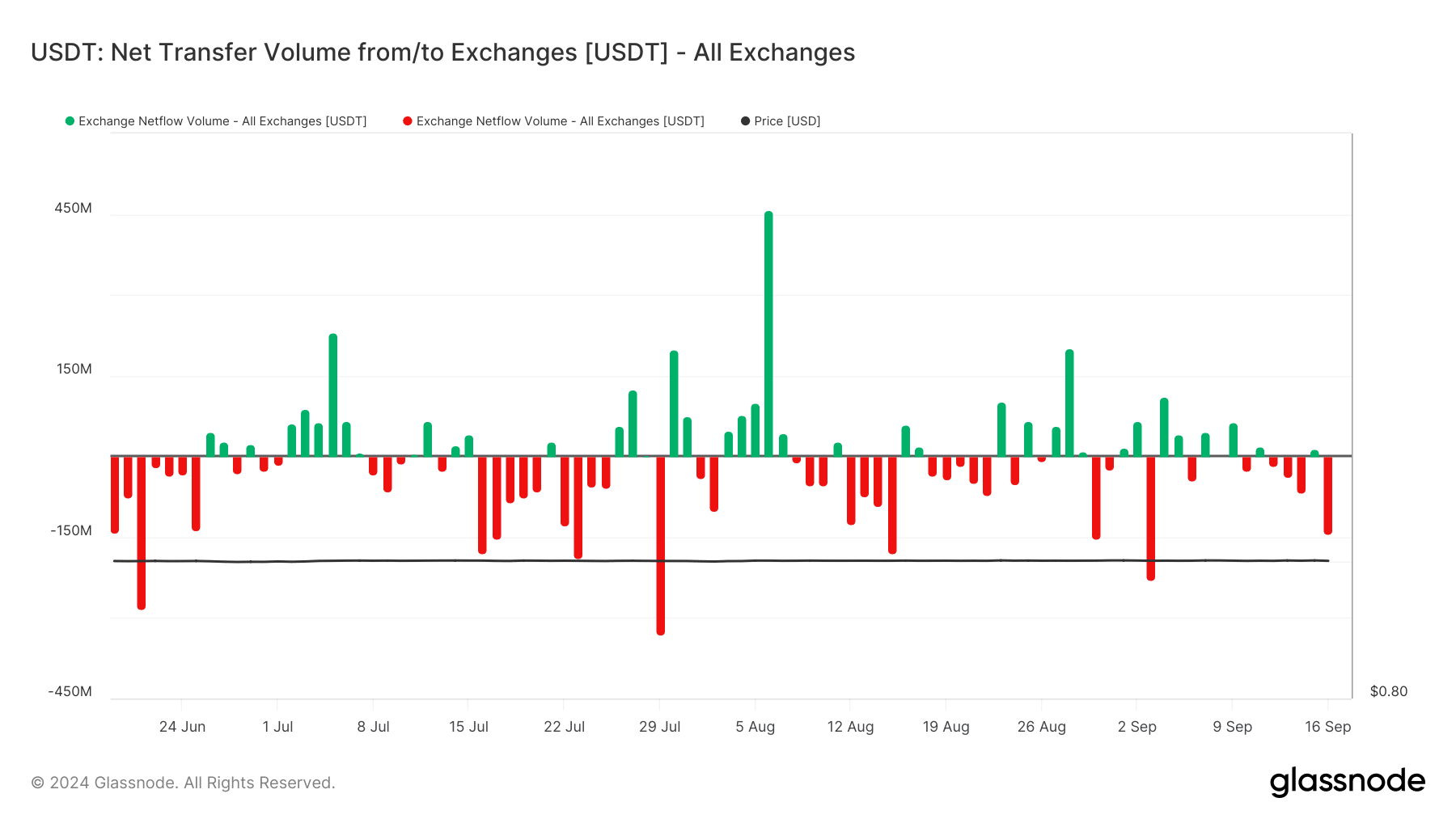

Surprisingly, the chart under presents a pointy distinction to this expectation.

Supply : Glassnode

The tremors have led to panicked stakeholders, proven by consecutive adverse flows. Traders could have shifted capital into USDT for security whereas Bitcoin’s value fell, reflecting a liquidity shift quite than a direct correlation.

Put merely, the bounce in USDT provide didn’t correlate with elevated Bitcoin demand; different components is perhaps at play.

On the sixteenth of September, the Tether treasury minted 1 billion USDT tokens, inflicting the sharp 0.37% rise in its provide.

Whereas this might counsel confidence in value restoration, it might additionally replicate liquidity demand or market hedging, not direct optimism.

Due to this fact, different dynamics should be thought of to gauge true confidence.

Stablecoin outflows might spark capitulation

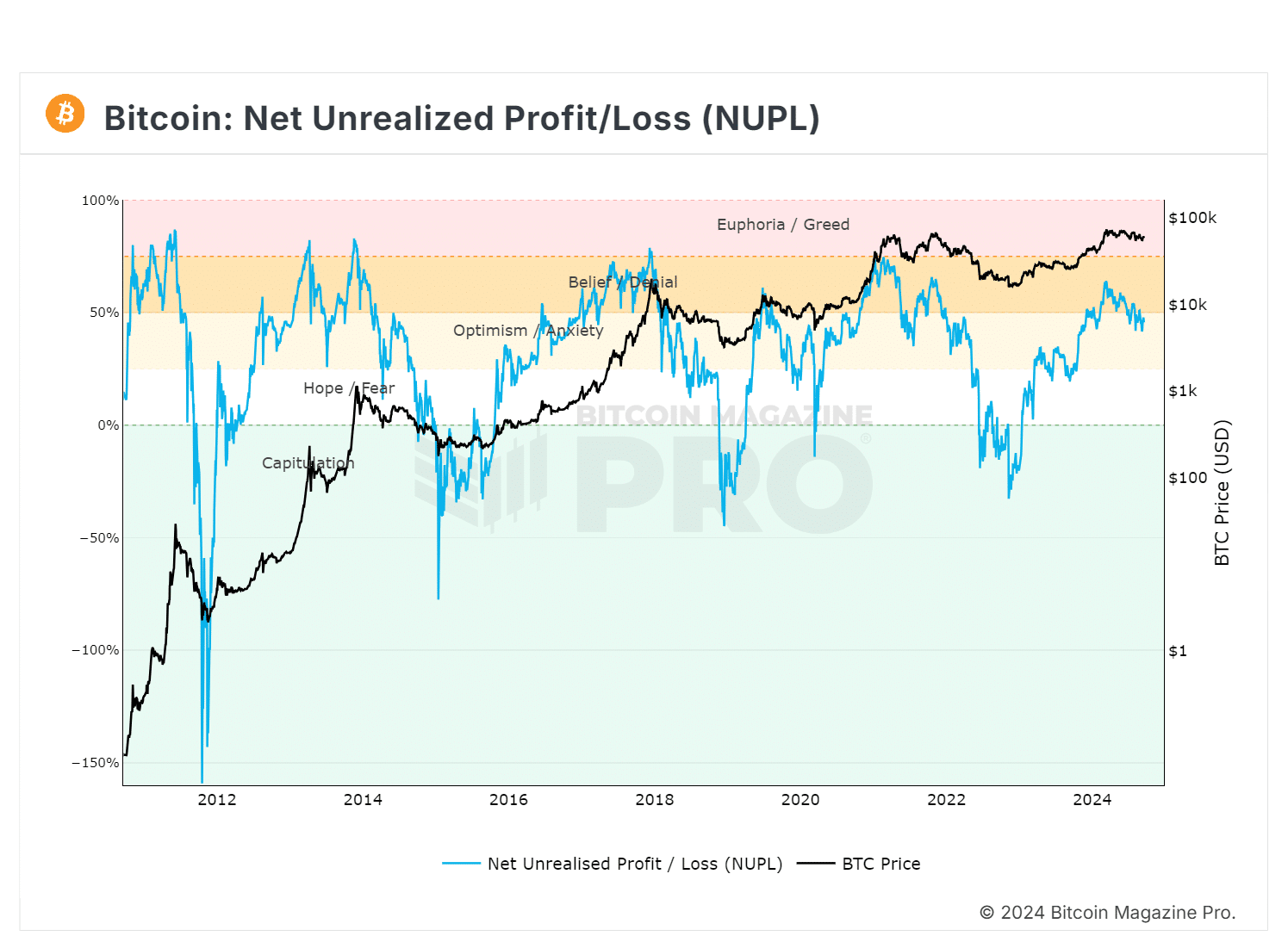

The chart reveals many Bitcoin holders are in revenue, which is bullish however could sign a market high as excessive NUPL might result in profit-taking and potential corrections.

Supply : Bitcoin Journal Professional

Conversely, rising USDT outflows might flip NUPL adverse, indicating unrealized losses and attainable promoting to interrupt even.

The precise place will turn out to be clearer after the FOMC assembly. If bulls act decisively, revenue holders would possibly preserve their good points.

Nevertheless, nearing the $55K vary might set off elevated USDT outflows, signaling potential capitulation.

Learn Bitcoin (BTC) Value Prediction 2024-25

For context, on the third of September, a large $230M USDT flowed out of exchanges on the identical day Bitcoin dropped practically 3%, following a 4% rise the day gone by.

This indicated that traders have been seemingly shifting capital to security, inflicting BTC to plunge under $54K in simply three days. If this pattern holds, BTC might retrace again to the identical help degree once more this time.