Picture supply: Getty Photos

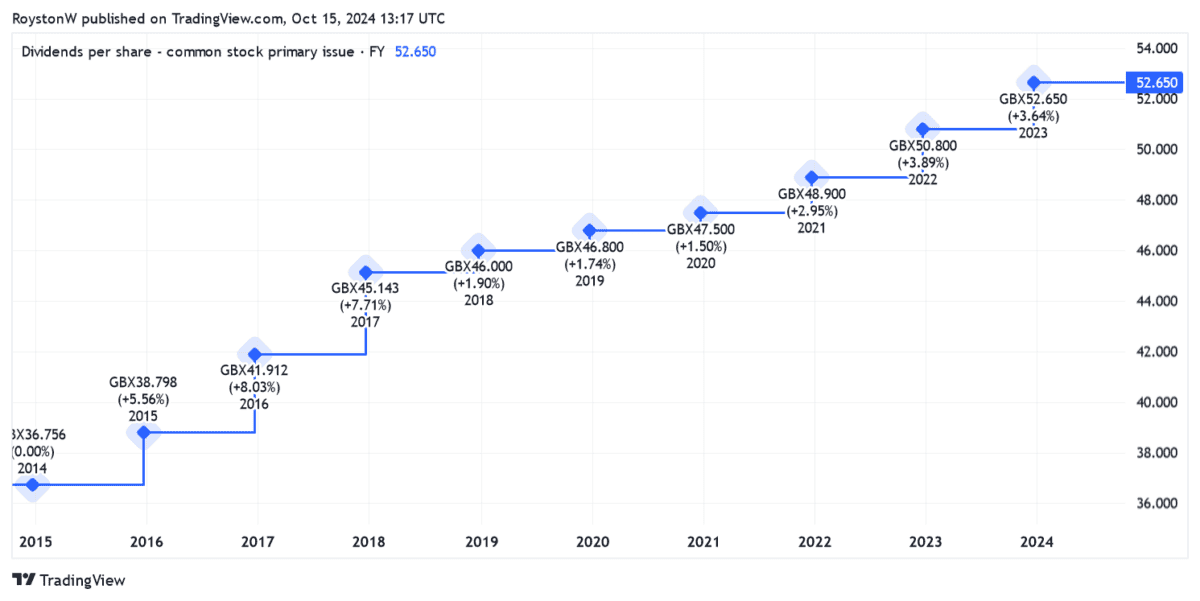

Phoenix Group (LSE:PHNX) shares have proved an distinctive funding for dividend buyers for greater than a decade.

Shareholder payouts have marched steadily increased in that point. And the yield on the FTSE 100 firm has lengthy crushed the index common of three% to 4% in the course of the interval.

Previous efficiency is not any assure of future returns. However encouragingly for revenue chasers, the Metropolis’s group of analysts expect dividends from Phoenix shares to maintain marching skywards.

So how a lot passive revenue might I make with a £10,000 funding at the moment?

11.1% dividend yield

Phoenix’s lengthy observe report of beneficiant and rising dividends displays its dedication to having a wholesome steadiness sheet. Even when earnings have fallen — which has occurred thrice up to now 5 years — money rewards have marched steadily increased.

Final yr, the Footsie agency raised the shareholder payout 4% to 52.65p per share. And because the desk under reveals, dividends are tipped by Metropolis brokers to maintain rising by to 2026 a minimum of:

| Yr | Dividend per share | Dividend development | Dividend yield |

|---|---|---|---|

| 2024 | 54p | 3% | 10.4% |

| 2025 | 55.6p | 3% | 10.8% |

| 2026 | 57.3p | 3% | 11.1% |

As you possibly can see, the dividend yields on Phoenix shares are subsequently two to a few instances bigger than the FTSE 100 common.

And even when dividends fail to develop past 2026, I might nonetheless make a four-figure month-to-month dividend revenue with a lump sum funding.

Compound features

Let’s say that I’ve £10,000 that’s prepared to speculate. If dealer forecasts are correct, this could internet me:

- £1,040 in dividends in 2024

- £1,080 in dividends throughout 2025

- £1,110 value of dividends in 2026

If dividends remained locked at 2026 ranges, in the course of the subsequent decade I’d get pleasure from £11,100 in dividends. Over 30 years, I’d make a £33,300 in passive revenue.

That’s not dangerous, I’m certain you’ll agree. Nevertheless it’s not as a lot as I’d make by reinvesting my dividends, or compounding my returns.

An enormous passive revenue

If I used this frequent funding technique, I’d — after 10 years, and based mostly on that very same 11.1% dividend yield — have made £22,208 in dividends. That’s greater than double the £11,100 I’d in any other case have made.

On a 30-year foundation, the distinction is even starker. With dividends reinvested, I’d have made a passive revenue of £291,653. That dwarfs the £33,300 I’d have generated with out reinvestment.

With my £10,000 preliminary funding added, my portfolio can be value a staggering £302,653 (assuming zero share worth development). With a 4% annual withdrawal, I’d have £12,106 of passive revenue, which equates to £1,009 a yr.

Shiny outlook

That mentioned, I’m anticipating Phoenix’s share worth and dividends per share to rise strongly over this timeframe, too, a state of affairs that might give me an excellent greater second revenue.

I anticipate income right here to balloon within the coming many years, because the UK’s booming aged inhabitants drives demand for pensions and different retirement merchandise.

If it might probably keep a powerful steadiness sheet, Phoenix might proceed paying massive dividends whereas investing for development, too. Encouragingly, its Solvency II ratio is a formidable 168%, in accordance with its newest financials.

The corporate faces important aggressive pressures that would blow earnings and dividends off target. However all issues thought of, I believe Phoenix shares are value a really shut look proper now.