Picture supply: Getty Pictures

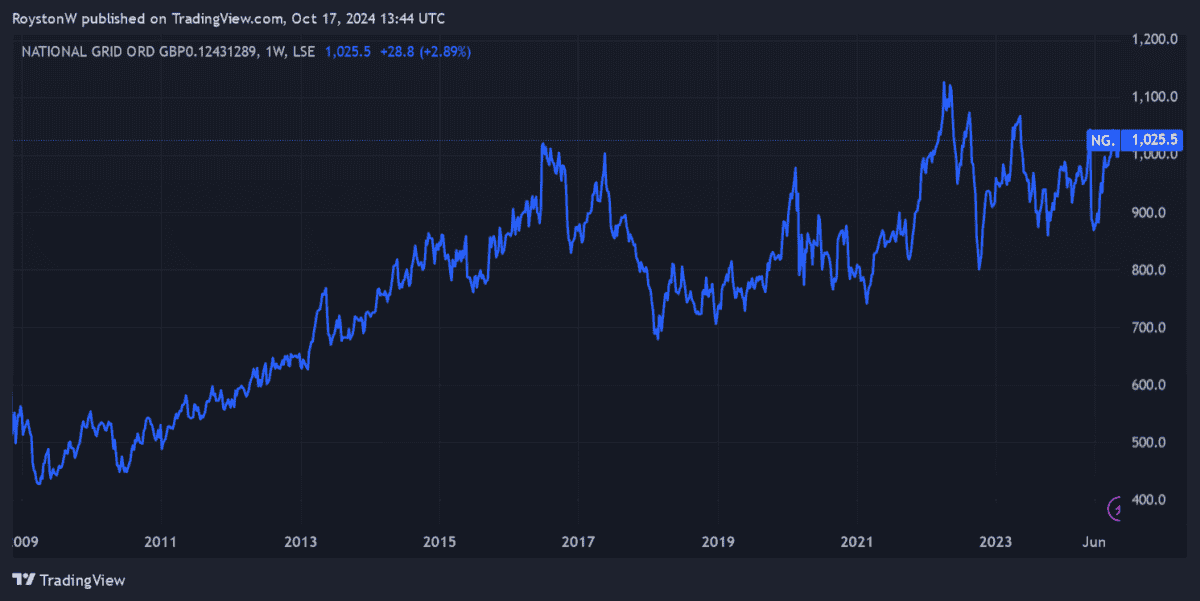

Nationwide Grid (LSE:NG) gives one of many largest dividend yields on the FTSE 100, above 4.5%. Utilities shares like this are sometimes in style with earnings seekers, as their defensive operations give them wonderful earnings visibility, and subsequently the means to pay a secure dividend over time.

Nonetheless, this hasn’t been the case with Nationwide Grid extra just lately. Extra particularly, it’s been pressured to chop money rewards for this monetary 12 months (to March 2025) to lift funds for future funding.

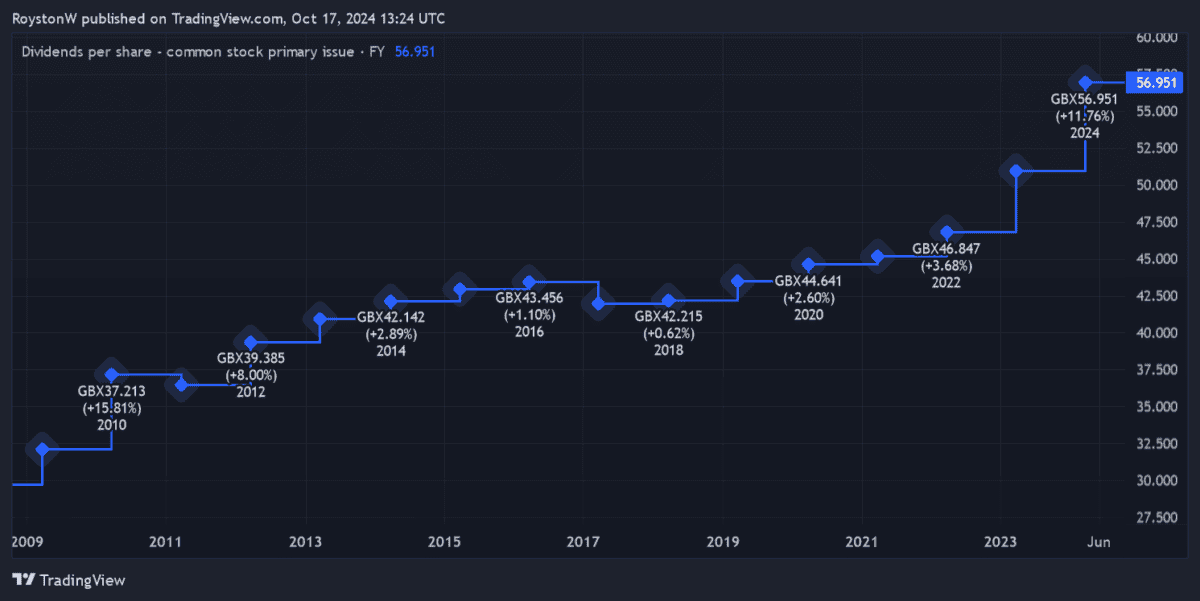

The truth is, the ability grid operator’s deliberate dividend discount this 12 months means it will have minimize payouts thrice since 2010, because the chart beneath exhibits.

The excellent news, nevertheless, is that Metropolis brokers suppose dividends on Nationwide Grid shares will rebound instantly following this 12 months’s minimize.

With this in thoughts, how a lot passive earnings might I make with a £10,000 funding at the moment?

Rising yields

To rapidly recap, Nationwide Grid’s dividend per share for this 12 months will drop following its £6.8bn share putting in Might. It issued new shares to assist it fund a £60bn five-year development drive to decarbonise the UK’s energy community.

Metropolis analysts suppose the whole dividend will fall 20% 12 months on 12 months, to 46.78p per share. However in addition they imagine dividends will rise thereafter, in step with Nationwide Grid’s plans. The corporate intends to extend payouts in step with the speed of shopper worth inflation together with proprietor occupiers’ housing prices (CPIH).

| Monetary 12 months | Dividend per share | Dividend development | Dividend yield |

|---|---|---|---|

| 2025 | 46.78p | -20% | 4.6% |

| 2026 | 47.78p | 2% | 4.7% |

| 2027 | 49.18p | 3% | 4.8% |

Even when dividends fail to rise once more past 2026, I might make a wholesome passive earnings with a £10,000 funding at the moment, if these estimates are appropriate.

A £1,683 second earnings

If I invested that lump sum at the moment, I ought to make £480 within the 12 months to March 2026.

This is able to grow to be £4,800 over a 10-year horizon. And over 30 years I might web a really wholesome £14,400.

Nonetheless, I could have an opportunity to make a fair higher second earnings over that point. How? By reinvesting any dividends I obtain, and thus rising my pot exponentially because of the mathematical miracle of compounding.

This technique would make me £6,145 over 10 years, and £32,086 in the course of the course of three a long time. Added to my £10,000 preliminary funding, my portfolio may very well be value a complete £42,086, assuming that Nationwide Grid’s share worth stays secure.

If I then selected to attract 4% of this quantity down, I’d have an annual passive earnings of £1,683.

A strong choose?

Given Nationwide Grid’s development plans, there’s no assure that dividends received’t fall once more. The costly nature of its operations additionally means future payouts may very well be in peril.

However over the long run, I’m optimistic that dividends might develop strongly, underpinned by the agency’s plan to develop its asset base by 10% a 12 months. This might additionally result in wholesome share worth features and a strong general return.

Nationwide Grid’s traders haven’t had a simple time of late. Nonetheless, on steadiness, I nonetheless suppose it’s a dividend inventory value critical consideration at the moment, underpinned by its wonderful defensive qualities.