Picture supply: Getty Photos

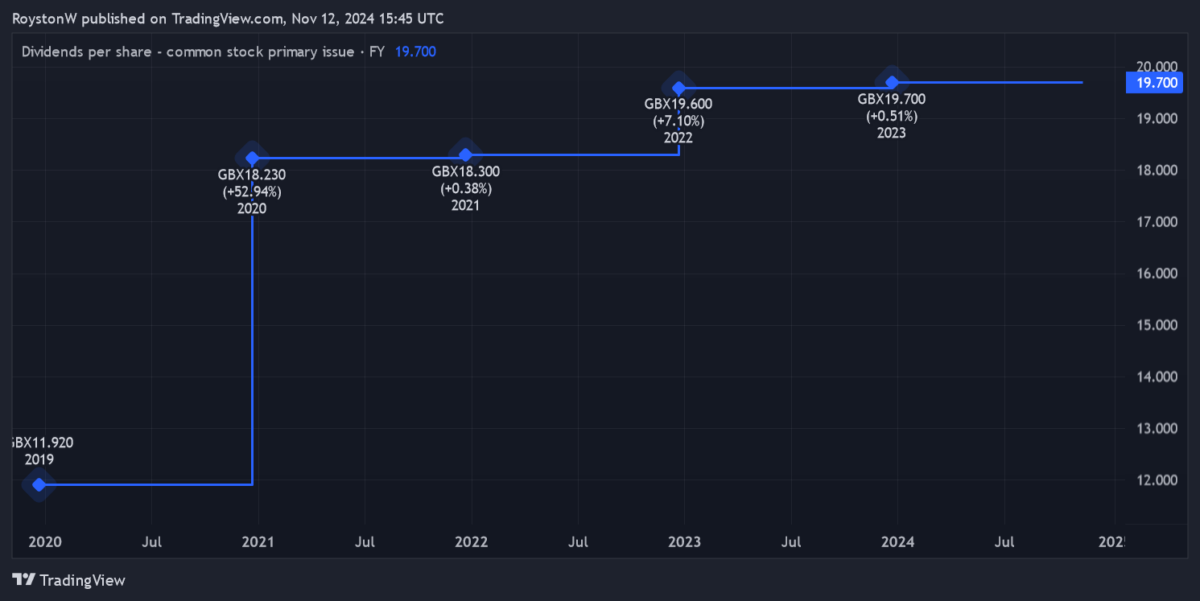

M&G‘s (LSE:MNG) been one of many FTSE 100‘s best dividend shares to purchase in current occasions. Not solely have dividend yields smashed the market common since 2019. Shareholder payouts have risen steadily because the firm was spun out of Prudential 5 years in the past.

What makes M&G such a gorgeous share to me right now is its double-digit dividend yield. For 2024, solely Phoenix Group carries a bigger yield on the Footsie right now.

And because the chart beneath reveals, Metropolis analysts anticipate money rewards to maintain rising to 2026 not less than, pushing the yield even additional above 10%.

| 12 months | Dividend per share | Dividend development | Dividend yield |

|---|---|---|---|

| 2024 | 20.07p | 2% | 10.2% |

| 2025 | 20.63p | 3% | 10.5% |

| 2026 | 21.26p | 3% | 10.8% |

Nevertheless, earlier than shopping for any dividend share, I want to consider how practical present forecasts are. I additionally want to think about whether or not M&G’s share value will preserve sinking, which may offset any giant dividends.

Right here’s my verdict.

Monetary foundations

On first look, these predicted dividends on M&G shares seem considerably fragile. This evaluation’s based mostly on the easy-to-calculate dividend cowl ratio. As an investor, I’m on the lookout for a large margin of security, particularly a studying of two occasions and above.

Sadly, the anticipated dividend for this yr’s truly larger than estimated earnings. And whereas income are tipped to surge in 2025 and 2026, dividend cowl’s nonetheless weak, at 1.2 occasions and 1.3 occasions respectively.

In principle, this leaves dividend forecasts in peril if earnings disappoint. Nevertheless, M&G has a cash-rich stability sheet to fall again on if income underwhelm.

Its Solvency II capital ratio — a key sign of liquidity — was 210% as of June, double the regulatory requirement and up 7% yr on yr.

Encouragingly for future dividends, M&G’s additionally lately upgraded its three-year money technology goal, to £2.7bn from £2.5bn beforehand.

Strong outlook

On stability then, I believe there’s a terrific probability that M&G will meet brokers’ dividend forecasts. Poor dividend cowl in recent times has been frequent. But it hasn’t stopped the distribution of huge and rising money payouts.

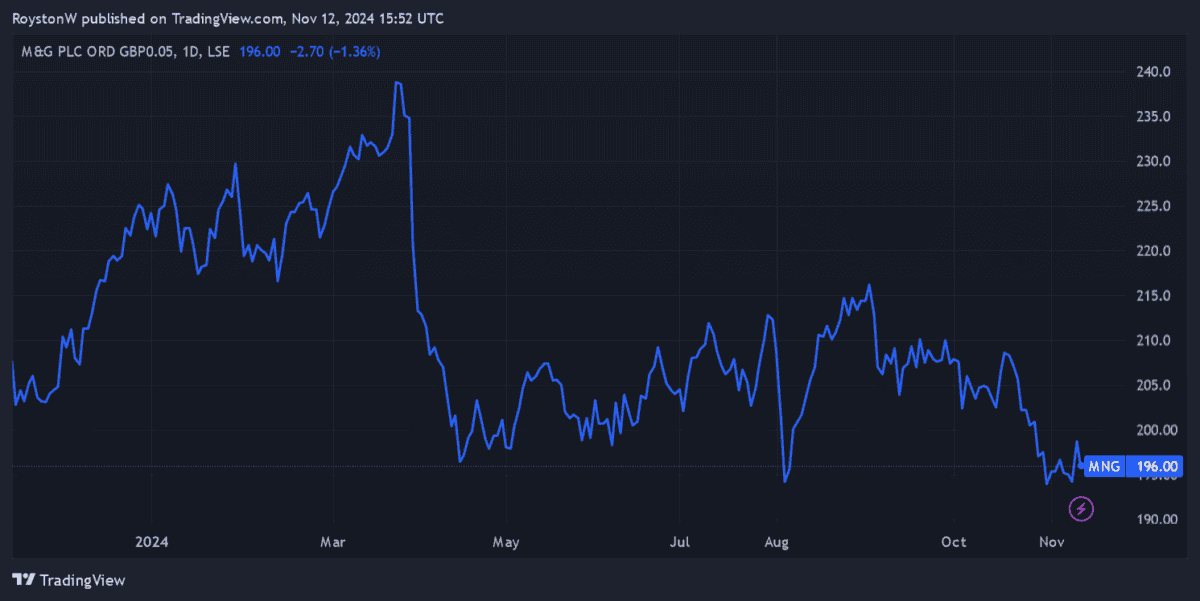

However does this make the enterprise a possible purchase? As I say, its share value slumped from late March after the corporate went ex-dividend. And it’s continued to battle since then as worries over the UK financial system persist.

Nevertheless, I anticipate M&G’s shares to recuperate strongly over time. As a number one supplier of pensions and different funding merchandise, I anticipate income to steadily rise as an ageing inhabitants drives demand for retirement providers.

Although it faces excessive competitors, I really feel the FTSE agency has the experience and the model recognition to capitalise on this chance.

The decision

At 196p per share, M&G shares provide these large 10%-plus dividend yields. However that’s not all for worth chasers to get enthusiastic about. Its price-to-earnings development (PEG) ratio for this yr is simply 0.4. Any studying beneath 1 suggests a share’s undervalued, based mostly on anticipated earnings.

It’s not with out danger. However, on stability, I believe M&G’s a high dividend share to think about. And particularly at right now’s value.