- Since September, a persistent imbalance within the buy-to-sell ratio has strengthened BTC’s bullish outlook.

- Buyers are buying $80 billion value of BTC month-to-month, underscoring demand and rising confidence within the asset.

Bitcoin’s [BTC] upward pattern might persist regardless of minor retracements, as noticed within the every day timeframe. The asset just lately skilled a 0.28% decline, which seems to be a pure pullback inside its broader rally.

AMBCrypto highlights this worth fluctuation as a part of BTC’s prolonged rally, which is analyzed in larger element under.

Brief-term holders stop main BTC worth decline

A current report from analyst James Van Straten reveals important buying and selling exercise within the BTC market since September, serving to to stabilize BTC’s worth. The Lengthy/Brief-term holder threshold presently stands at 1.28, suggesting a powerful choice for accumulation.

Because of this for each 1 BTC offered, consumers are stepping in to buy roughly 1.28 BTC, which is indicative of persistent demand.

A more in-depth evaluation reveals that long-term holders (LTH)—addresses holding BTC for over two years with out transacting—have been answerable for many of the sell-offs. In the meantime, short-term holders (STH) or early buyers actively drove the shopping for exercise.

Supply: X

Between September and now, a complete of 843,113 BTC was offered, whereas 1,081,633 BTC was collected. Each day, consumers acquired 12,432 BTC, in comparison with 9,690 BTC offered.

This imbalance in favor of shopping for displays bullish market sentiment, as elevated accumulation prevents BTC from experiencing a pointy worth decline. The sustained demand has doubtless helped BTC keep its place above the $90,000 vary following its current all-time excessive.

Historic second for BTC

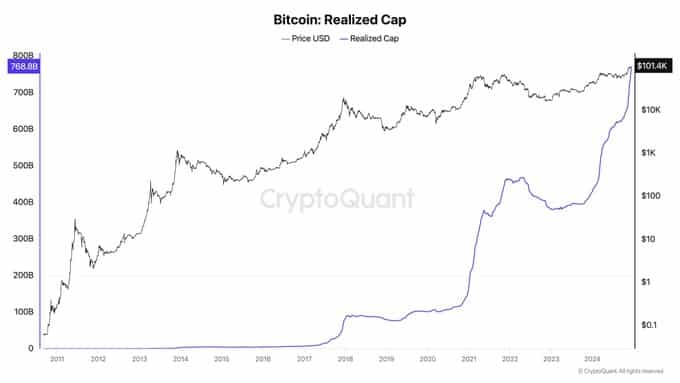

In line with analyst Ki Younger Ju, Bitcoin has seen a big inflow of funds, with shopping for exercise reaching $80 billion per thirty days.

This growth is a extremely bullish indicator for BTC, suggesting that adoption is steadily growing. Extra retail buyers are coming into the market, buying BTC in larger portions than ever earlier than.

Ki Younger Ju highlighted this momentum, stating:

“Nearly half of the capital that has entered the Bitcoin market over the past 15 years was added this year.”

Supply: X

If this pattern continues, BTC’s long-term outlook stays robust, positioning the asset for sustained upward motion.

AMBCrypto additionally analyzed BTC’s instant market exercise to evaluate its short-term outlook.

BTC maintains bullish momentum

Regardless of a 0.28% dip in BTC’s worth over the previous 24 hours, market indicators proceed to sign a bullish outlook.

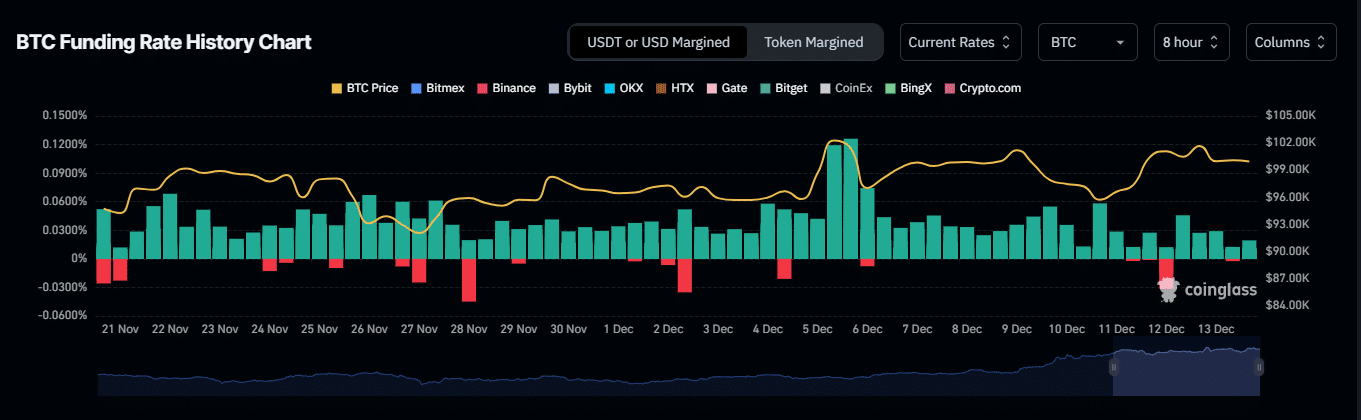

As of this writing, BTC’s funding fee stays constructive at 0.0100% during the last eight hours, in accordance with information from Coinglass.

A constructive funding fee means that lengthy merchants keep worth stability in each spot and futures markets, reflecting an general bullish sentiment and creating alternatives for additional worth development.

Supply: Coinglass

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Moreover, an evaluation of BTC’s long-to-short contract ratio reveals it stays impartial at 1. A transfer above or under this stage might decide the market’s subsequent directional bias.

Contemplating BTC’s long-term outlook and the constructive funding fee, the present fluctuation seems to be a minor retracement, with the bulls sustaining a bonus.